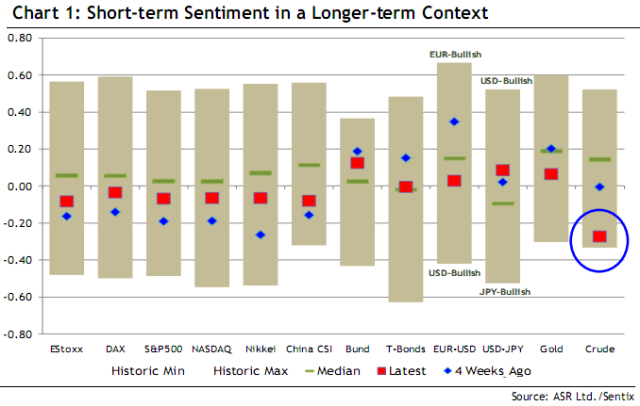

As a follow-up to last week’s commentary on crude oil sentiment and fading the IAE here is the latest Sentix sentiment overview showing the exceptionally pessimistic sentiment in crude oil:

The only other market approaching this level of gloom and doom is China’s equity market. Here’s a more detailed look at the Sentix (short term) crude oil sentiment index:

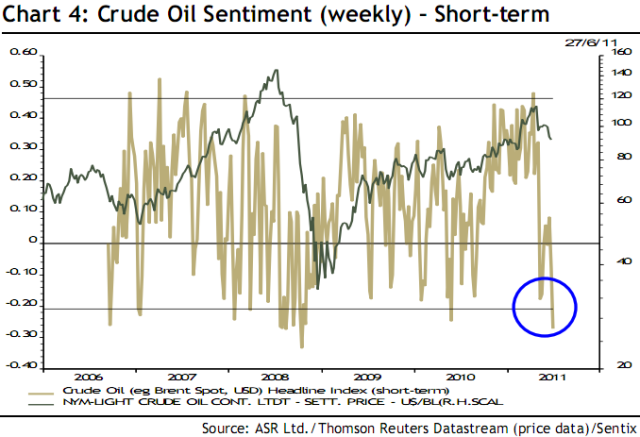

The last time that we saw such an extremely negative sentiment from this indicator was during the 2008 crash in oil prices. Back then I wrote about the dangers of being long the crude oil market as it approached clear parabolic status and called it a ‘bubble’.

It is notable that the decline in price we have seen since early May does not even being to approach the catastrophic declines that occurred in 2008. But even so, sentiment is now as negative as it was back then. From a contrarian perspective, this suggests that it is smart to fade the IEA’s recently announced sales.

Apart from a directional bet, another way to play this is to position a trade that takes advantage of the narrowing of the gap between the Nymex and Brent crude oil markets. As of Monday the spread is a little over $13 but earlier this month it ballooned to $23 a barrel. Usually Brent trades at a small discount to West Texas Intermediate Crude and over the next few weeks, the lopsided sentiment suggests we’ll see an eventual return to that.

Sentiment has been extremely volatile in the past couple of weeks. I wouldn’t trust it much to positino myself. Just check this

Better maybe to focus on the COT for commodities.

I like your work, but I think you should take another look at your chart. The initial drop from the ’08 highs produced the same level of negative sentiment as we’re showing now, but that was only the very start of the falling knife. There was another 75% drop coming from that point.

Yes, we MAY be at a significant bottom, but it may only produce a small bounce with more pain to come (for longs). You know as well as anybody, I assume, that using sentiment can be a very tricky game. And that if you don’t see a significant bounce when sentiment is significantly negative, that’s a very ominous sign, and much more downside is likely.

I’m liking your notion that oil sentiment has gotten bad enough to warrant a bounce. However, I would rather have seasonality on my side too, and seasonality suggests that mid July is a good time to get long exposure to oil, so I’ll chance the wait.