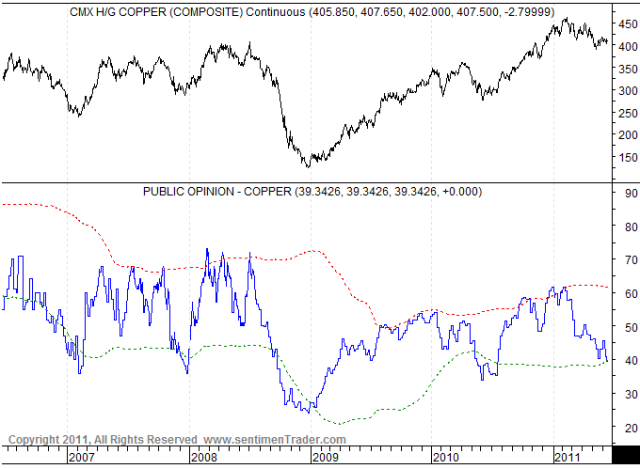

Yesterday while discussing copper prices I hinted that crude oil was in a similarly washed out circumstance when it comes to sentiment. Today’s decision from the International Energy Agency (IEA) to release 60 million barrels of oil from their strategic reserves sent crude oil prices down further and deepened an already oversold condition (Press Release).

The US will release half of the total IEA sum with Europe releasing 18 million and Asian countries another 12 million. The news was enough to send crude oil down sharply. This is an indication of the current pessimistic outlook holding sway over this market. If anyone had actually stopped to do a back-of-the-envelope calculation they would have noticed that this amounts to very little indeed.

Consider that the global consumption is running at 89 million barrels a day. So 60 million will cover it for a bit more than 16 hours. According to the US Energy Information Administration, the average daily consumption of crude oil in the US was 18.7 million barrels in 2009 and 19.15 million in 2010. So the US portion represents about a day and a half’s worth of oil.

Finally, although the big number in the news is 30 million, there is no guarantee that that amount will be supplied. The process in the past has been to invite bids from private companies to sell the crude. In 2005, after the disruption caused by Hurricane Katrina, the US government made available 30 million through a similar ‘notice of sale’. They received 14 bids, of which only 5 were accepted and in the end, resulted in total sale of only 11 million barrels of oil.

What the crude oil market may be reacting to is the implied threat from the IEA to become a more active player to massage prices lower. No doubt today’s IEA announcement was a not so subtle hint to Saudi Arabia.

The real story is whether Saudi Arabia will in fact turn on the spigot as they have threatened to do after the disastrous OPEC meeting earlier this month. On one side stands Saudi Arabia and on the other Iran and Venezuela. If the US friendly Saudis do in fact increase supply and push down demand (with a little help from the unwinding of the long-only futures bets put on by the hedge funds) then we will see something akin to QE3. Something else complicating this is the difference in the quality of the marginal oil production that Saudi Arabia can add. The loss of the Libyan oil is exaggerated by the fact that it was some of the lightest and sweetest crude available while the Saudi Arabian oil is sour and requires much more refining.

Realistically though I’m not sure how an international agency whose purpose is to stockpile crude oil in the event of a catastrophic supply disruption will now take on the role of a supplier. The two roles are diametrically opposed. There is no doubt that the global economy needs lower oil prices but whether the IEA’s machinations will provide that is up for debate.

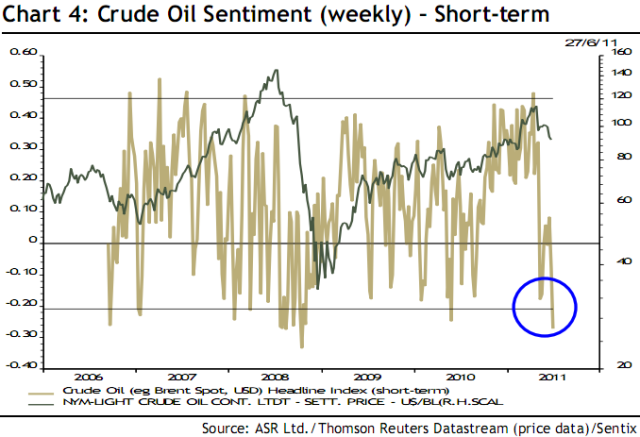

In the middle of all this there may be a trading opportunity if we look at this from a contrarian view point. First, some of the best buying opportunities camouflage themselves amidst a thicket of negative headlines. Second, price has already been going down for some time, falling more than 19% from a top in April. Like equity prices, crude oil reached its 200 day moving average.

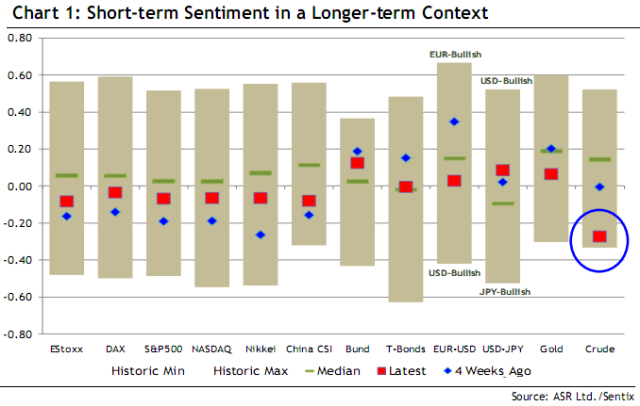

And third, sentiment towards crude oil is running low. By the end of the week we’ll have some new numbers to work with but the latest shows a significant deterioration in bullishness. We’re now seeing about as much negative sentiment as we did last summer.

Finally, the Commitment of Traders reports show that the Commercials are rapidly reducing their gargantuan net short position – built up during the first quarter of this year. And both Large and Small Speculators are rapidly moving to reduce their large long positions.

While as a consumer and as a global citizen I wish for lower oil prices, the current market cross currents and sentiment suggest that we’re about to see the opposite.

Most analysts are similarly suggesting that future prices will be higher. Here’s a brief rundown from Reuters:

GOLDMAN SACHS

We estimate that a 60 million barrel release by the end of July has the potential to reduce our 3-month Brent crude oil price target by $10-12 a barrel, to $105-107 a barrel.

We would expect the release to have less of an impact on prices further out the curve, as the oil would be absorbed to meet current demand.

Net, we would expect that the potential impact on Brent crude oil prices in 2012 to be closer to $5-7 a barrel on average

JP MORGAN

It is important to recognize that the IEA countries will “offer” or “make the petroleum available” to theSource: IEA Oil Market Report market. That does not necessarily mean that the oil offered will be taken up… For political expediency, the IEA is unlikely to want to be seen. There is an implicit, but not yet apparent” release price”.

PRESTIGE ECONOMICS

While this is price bearish for crude oil today and in the immediate term, these measures are being implemented with the intent to stave off significantly higher prices in the near- and medium-term. The fact that the IEA had to go to these lengths in the second year of an expanding business cycle says something very bullish about crude oil prices in the medium-and long-term. The global economy is up against a wall in terms of receiving additional oil supplies to meet demand. Additional demand or supply disruption would have a massively bullish impact on prices. After all, releasing emergency inventories is a last resort.

CAPITAL ECONOMICS

Our view has always been that oil prices would fall anyway given the deteriorating prospects for demand and the likelihood that some OPEC members, led by Saudi, would raise output regardless of the formal ceilings. Overall, the result on Thursday was fresh falls in equities and commodity prices, and in safe haven government bond yields, with the dollar regaining ground. We expect more of the same over the rest of the year, consistent with our view that the US S&P 500 will hit 1200; Brent crude will be back below $90pb.

As well, Gregor.us is equally bullish:

Releases of oil from inventory are counterintuitively bullish, not bearish, for prices. While oil prices no doubt will be rocked for several months now, releases such as these only highlight the fundamental problem at hand: structurally restrained supply. For example, the OECD could have turned to non-OPEC producers within their sphere of influence and asked them to produce more. But Non-OPEC producers, accounting for 57% of total global supply, have no spare capacity. The oil market is going to figure this out more quickly than most imagine.

As is Jim Ritterbusch of Ritterbusch & Associates. He believes oil will be back above $100 by the end of the summer.