In February I shared a chart of the Bloomberg Copper Sentiment index and wrote:

It would be truly poetic if copper were topping here, as sentiment suggests. After all, with the advent of not one but two physical copper ETF’s the ducks are about to get fed.

With hindsight we now know that copper did in fact peak in February. Since then it has meandered lower, participating in the general commodity retracement. The introduction of the two ETFs (iShares Copper Trust ETF and the JP Morgan Physical Copper Shares ETF) were fantastic sentiment signals.

To be fair, before I pat myself too furiously on the back, I had been negative on copper since late 2010 when I wrote “Copper Loses its PhD Moniker“. But the commodity totally ignored my brilliant analysis and kept going up.

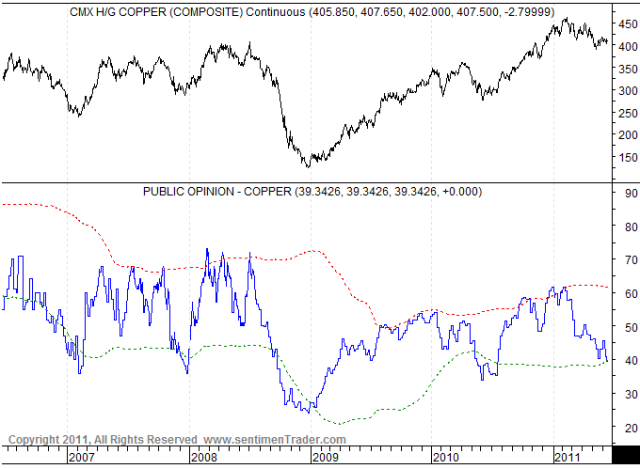

Now, after some months of tepid correction, copper sentiment is down to levels that have usually marked significant lows. The Bloomberg Sentiment which I pointed to previously is not yet down to abysmal levels. Its 4 week moving average has fallen from a spike of 76% to 62% (chart can be seen here). But an aggregate measure of copper sentiment which takes into account several surveys, including the Bloomberg one, from the always sharp mind of Jason Goepfert (of SentimenTrader) is showing an exhaustion of the bullishness that was prevalent back in Febuary:

Source: SentimenTrader.com

What’s surprising is the relative shallowness of the current correction and how in spite of it being so milquetoast, it has somehow managed to depress most people involved in this commodity. From peak to trough copper retraced 15.6%. Silver during the same time fell 31%. Copper is a rather volatile commodity and it isn’t unusual to see large retracements. For example, last summer it corrected almost 24%.

Commitment of Traders

We have corroborating data from the CFTC issued Commitment of Traders reports. The latest data shows a complete reversal of positions between the major market participants. Whereas in early 2011 Commercials – miners like Freeport-McMoRan (FCX) – were short and Small Speculators (retail futures traders) long, the current market is characterized by the opposite.

Of course, the fundamental issues that troubled me haven’t really been resolved. Copper is still being punted about as a plaything for the large speculators decoupling it from its historical normative demand/supply forces. But the sentiment and Commitment of Traders reports both suggest that the correction here has been enough to flush out the weak hands and prepare copper for another leg up.

Almost the same can be said for crude oil by the way.