While gold is still flirting with its all time highs, the consolidation that has now lasted about 12 weeks has managed to sap the spirits of most participants in the sector. Below I’ll cover four indicators which are suggesting that the consolidation will be followed by higher prices.

Newsletter Editor Sentiment

According to Mark Hulbert, keeper of the Hulbert Stock Sentiment index, the specialized Hulbert Gold Newsletter Sentiment index (HGNSI) which looks at the market exposure recommendations of newsletter editors that focus on gold has actually declined.

On November 23rd, 2010 when gold was trading at almost exactly the same price as it is now, the HGNSI was 40.3%. This means that the average newsletter editor was suggesting to their clients to have 40.3% of their portfolio long gold stocks.

The current HGNSI level is 33.6%. Not a large drop but still a drop. But you have to remember that gold has not corrected more than 7% since entering this latest sideways trading range and that it is within a stone’s throw of its high.

The highest HGNSI level for 2010 was 61% registered at the beginning of the year and 59% in mid-October 2010.

Closed End Fund Premium/Discount

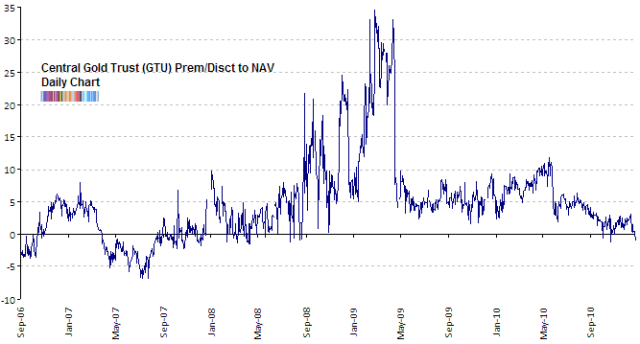

Another sentiment indicator is the showing a similar level of indifference is the premium/discount for Central Gold Trust (GTU). This is a specialized gold focused closed end fund and unlike the SPDR Gold Trust (GLD) it can trade at considerable premium or discount to its net asset value (NAV).

I’ve mentioned it before a few times (most recently: Sentiment Addendum: NAAIM, Gold, DSI & Insiders). When investors bid up the price of GTU above its NAV they are willing to ‘overpay’ to own gold. And when they sell it even when it is below its NAV, they are showing irrational pessimism.

Here’s a chart of the Central Gold Trust (GTU) premium discount over time:

Today it dropped into a 1% discount from NAV – the first time since October 2010. While the discount is small, it does show the same apathy towards gold shares as the HGNSI.

Neutrally Bullish on Gold

Here’s a video from Adam Hewison talking about the CurrencyShares Swiss Franc Trust (FXF):

The Swiss Franc usually trades in sync with the gold market. I’m not sure exactly why. It may have to do with the fact that the Swiss Franc has to be backed by a minimum of 40% gold. Or that it represents a very risk averse country. Or that historically the Swiss have been financially rock solid sailing through history as a neutral country.

The point is that the Swiss Franc has an intimate relationship with gold and as you can see from the short video above, it is setting up for another rally.

Gold Sector Breadth

The short term breadth in the sector has fallen to level which previously have corresponded to an imminent rally. The percentage of components in the Philadelphia Gold Bugs index (HUI) trading above their 50 day moving average is down to 15%. Usually when we see this breadth indicator fall below 20%, an intermediate rally takes prices higher.

These coupled with the gold analysis from yesterday leads me to believe that we are setting up to take out the recent highs.

Thanks Babak. Where do you get the HUI breadth info?

Broke short-term support today at 1370. Next support level appears to be a1 1330, and after that the rising 200 DMA at 1270. Every major upmove since late 2008 rebound has been followed by a correction that takes it back close to the 200 DMA BEFORE the next big upmove can begin. I’m still looking for a repeat of last year’s correction which bottomed at the 200 DMA in February.

Very long-term I remain super-bullish. I’m in the 3000-5000 or beyond camp. It will end in a true bubble move. Intermediate-term, I have no clue. Near-term, I’m bearish. This consolidation/correction has not fully run its course.

Pingback: GTU Premium | The Daily Gold

Pingback: GTU Premium | Energy and Metals

Thanks, Babak. Fine work.

May I suggest: As with the tech bull market of the 1980s and 1990s, the gold bull market has reality. There are many people who believe in hard money. They/we don’t like “money” that is conjured up at political whims. Thus the ultimate point of gold investing should be simply that gold and/or silver has been money somewhere in the world at some point for thousands of years, and remains an official store of wealth today per IMF and government financial reserves. Thus I am a gold investor because I am saddened by the policies of governments and the financial community.

FYI As a minor point today but relevant on days of big intraday swings in gold prices, the way GTU calculates NAV is based on London’s PM gold fix. Should the price move suddenly in NY in the afternoon, the true premium/discount should be adjusted for the NY close to match the close of trading.

Finally, re GTU and PHYS (which has gone flatline for the last 8 months since its wild price premium to NAV after coming public), it is an interesting theoretical question as to what “fair value” for a fund that owns gold should be. After all, a fund has expenses that it must pay every year, which it pays by selling gold (or by selling stock to investors and retaining cash). And in a true crisis, who knows who will pay you for your shares; people may only be interested in physical gold in their possession. But I agree with you from a trading perspective that both PHYS and GTU show apathy; shares of ABX and GG show a bit of panic selling; and silver looks toppy; thus I admire your overall analysis.

The Swiss no longer back the Frank with Au….

Pingback: Sentiment Overview: Week Of January 14th, 2011 | tradersnarrative

Pingback: Sentiment Overview: Week Of January 21st, 2011 | tradersnarrative

Pingback: Renting Gold For An Opportunistic Trade Higher | tradersnarrative