Gold started the year off on the wrong foot. On January 4th the precious metal had the largest single day’s decline since July 2010. That shouldn’t have been surprising since there were several signs that gold was on thin ice.

In early December I wrote a negative piece on gold: Gold Looks Toppy. At the time, gold was trading around $1425.

So far gold hasn’t fallen dramatically but entered into a sideways correction phase. This is in line with my thinking. As I wrote back on December 8th, there was little conviction, from a contrarian viewpoint, of an impending dramatic decline:

…at the moment, there isn’t a very clear picture of gold from the various indicators we surveyed. Usually when faced with such a frustrating lack of edge, I stand aside but if I had to insist on taking a position it would be short term bearish.

But at the same time there were certainly signs that the bulls had overdone things. Among these was the Bloomberg gold sentiment survey which reached a peak of 90% bull ratio on December 31st 2010. As well as the enthusiasm of Rydex traders.

I wasn’t the only one who thought gold was on perilous footing. Just one day before the big fall, Mike Drakulich of EWI’s Metals Specialty Service wrote:

“I think we either have to top and reverse lower very soon… I will use a topping arrow for today. We are a critical short-term juncture. I suggest watching very closely to see if a sharp reversal might occur here at any time.”

That was of course, spot on. So where does gold stand now, after a month?

The small correction (or more accurately, sideways consolidation) has actually provided wrung out a surprising amount of bullish sentiment. If we check in with the Rydex traders, we see that they have dramatically reduced their dedication to the precious metals sector:

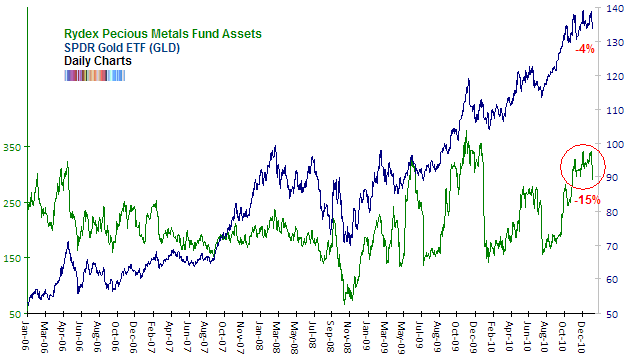

The chart above compares the total assets of the sector fund (in millions) with the SPDR Gold ETF (GLD). The most recent correction is just the start of what is usually a much more protracted decline in assets. So far, we haven’t seen a real abandonment of the sector from Rydex traders.

On the plus side, the SPDR Gold ETF (GLD) is down about 4% from its recent high. In contrast, the total assets of the Rydex Precious Metals fund is down about 15% from its recent high. So we are seeing an asymmetrical reaction. But from a contrarian viewpoint that’s just a good start.

As well, the Bloomberg sentiment poll has also reacted to the fall in gold price. The bull ratio adjusted this week to 42% from more than double that the previous week. The last time it was lower was on December 17th 2010.

Stealth Correction

The composite sentiment indicator from SentimenTrader is relatively low at 69.63%. Frankly, I’m surprised that it isn’t higher since gold is trading very close to highs – or at least it was. So here the gold bugs have some vindication that bullish sentiment isn’t as high as it merits, considering the strength of gold.

Most importantly, breadth in the sector is suddenly extremely poor. As of yesterday, only 8% are trading above their short term moving average (10 day). And just 23% are trading above their 50 day moving average.

From a longer term perspective, we still see breadth quite healthy with 62% of components trading above their 200 day moving average. Considering that gold is still assumed to be in a bull market, whenever the shorter term breadth indicators have been this oversold, we have seen a rebound in price.

In recent history, the last time this confluence of events took place was in late January 2010 and late July 2010. Both of those were the end of a corrective phase and a good time to go long.

Overall, it is surprising that a stealth correction has arrived via a sideways consolidation spanning October 2010 to January 2011. Short term sentiment has already reacted sharply while long term sentiment is not overly bullish. Breadth meanwhile continues to be supportive of higher prices.

The only caveat I’ll add is that gold equities move surprisingly in line with the general equity market. So if we expect the market to fall, then hiding out in gold stocks is not a good idea. I’m still not completely won over by the aggregate data but with just a few more down ticks from breadth and a give up from the Rydex traders, I’ll be happy to clamor on board once again and even call myself a “gold bug” again for a while.

Chuckles and Grins

Finally, if you haven’t yet, check out Colbert’s YellowLine commercial about the banana shortage and how you can cash in.

“I’ll be happy to clamor on board once again and even call myself a “gold buy” again for a while.”

My mate just said you need to grow some balls and short gold… Hahahaha!

In recent history, the last time this confluence of events took place was in late January 2010 and late July 2010. Both of those were the end of a corrective phase and a good time to go long.

Actually, the intermediate-term low was in February 2010 at 1044, NOT January 2010.

In both cases, gold pulled all the way to very near its rising 200 DMA. Since the late 2008 sell-off, every corrective phase back to the 200 DMA has been a great buying opportunity for the forward 6 months. There were 2 other corrective phases ending in April 2009 and July 2009 which also pulled back to or close to the 200 DMA.

Currently, we are still pretty far north of the 200 DMA, and the percentage decline doesn’t match the other 4 corrective declines. I am still looking for a deeper correction coupled with more bearish sentiment as an entry point. MACD is about to give a bearish ZERO crossing, and has been forming lower highs and showing a divergence with price for the last couple months.

There is short-term support at 1330ish and the rising 200 DMA is 1265 (and 1250-1260 was the last major break-out point) so I’m guessing the current decline halts either at 1330 or 1260-1270. Assuming a replay of last year, maybe that happens in Feb and sets up a great 3-6 month long opportunity. Hopefully, declining to those levels will bring out a chorus of “The Gold bubble is bursting” and give me even more conviction to totally back up the truck and load up. I made a good chunk on gold calls during the Sep-Nov move.

Mike,

thanks for your comment. If you read carefully what I wrote and what you quoted, it was “late January” – at which time gold fell to $1080ish and then in February it fell slightly in one big whoosh down to $1065ish (close, not intraday low $1044). As you can see, signals from breadth are not absolutely perfect but they are a good guide.

If you read my final thoughts you’ll see that we don’t really disagree on this matter:

babak, I agree this sentiment development is pretty good from a gold bull’s perspective. I had been thinking gold may begin a cyclical bear within its secular bull that might not resolve until 2012, but if sentiment keeps going the way it’s started that scenario becomes less likely IMHO. Another nice data point is that the NAV premium for GTU is already down to 0.3%.

Jim, the fact that sentiment is so quick to change should be reassuring for the bulls. If we saw stubborn optimism, then things would be different. The premium for GTU is down as you mention (0.22% I believe rather than 0.3% but that’s splitting hairs). As well, the bullish percent of the sector has also fallen from 93% (in November 2010) to 63% in this ‘stealth correction’.

Pingback: Musings On Gold Being In A Bubble & Its Eventual Crash | tradersnarrative

Pingback: Bullish Sentiment in Gold Abates | The Daily Gold

Pingback: Bullish Sentiment in Gold Abates | resourceINTELLIGENCE

Pingback: Bullish Sentiment in Gold Abates

Pingback: Bullish Sentiment in Gold Abates | Energy and Metals

Pingback: Bullish Sentiment in Gold Abates - Gold Speculator

Pingback: ETF DAILY NEWS » Bullish Sentiment in Gold Abates (GLD)