Here is the summary of sentiment data for this week:

Sentiment Surveys

The AAII survey of retail investors in the US was little changed with 36.8% polled believing that the S&P 500 index would be higher in the next 6 months. An almost equal portion (33.2%) believe the opposite. The result is that the rolling 4 week average of the bull ratio continues to fall. It reached a cycle peak of 74% in mid-January and since has fallen to 58%.

Doug Kass of Seabreeze Partners mentioned an interesting twist on the AAII survey in his guest appearance on CNBC’s Fast Money segment called the Farrell Sentiment Index. This is the ratio of bulls divided by the total of bears plus half of those neutral.

Kass says that there was a sell signal from this indicator as it rose above 1.50 in January:

When the ratio is under .50 and rising it’s a bullish signal. When it’s over 1.5 it’s bearish and the ratio rose to 1.50 on the week of January 14th – a definitive sell signal

I’ve never heard of this indicator before and a Google search only brings up the CNBC reference. If anyone knows more about it, drop me a line and let the rest of us know. The other puzzling thing is that the quote is wrong. The ratio did not go above 1.5 in January. It did so twice recently and they were on December 8th and on December 29th 2010.

Jason Goepfert of SentimenTrader.com (who is likewise unfamiliar with the indicator) reports that the buy signals are very good but the sell signals from this indicator are dubious at best.

AAII Asset Allocation

A bit more interesting than the opinion poll is the AAII’s monthly asset allocation poll. For the past few months, the rout in the bond market has spooked the retail US investors out of bonds and into equities. The bond allocation – which topped out on September 2010 at 25% of the total portfolio – is now at 17%. That’s a big drop within a short time frame but it isn’t at an extreme nominal level compared to previous years. Equities notched down slightly to 63%.

Investors Intelligence

The survey of newsletter editors this week was little changed with 50.6% bulls and 19.5% bears. The bull bear ratio fell to 2.6 from 2.8 last week. The peak of bullish sentiment for this indicator came about in mid January when we had 3 optimists for every 1 pessimist. Since then, we’ve hovered quite high but just shy of truly extreme levels.

Ned Davis Research Crowd Sentiment

The Ned Davis Research crowd sentiment poll which is a secret recipe comprised of multiple sentiment surveys is once again screaming high to indicate a market top. To be fair, it started to approach bullish extreme back in November 2010: NDR Crowd Sentiment Poll at April 2010 Highs when it reached 69%. Anything above 61.5% is considered to be “Extremely Bullish” sentiment by NDR.

Right now it is at 73%. To find a higher level for this metric we’d have to go back to November 2004 when it hit 73.5%.

NAAIM Survey of Manager Sentiment

This survey of professional money managers has backed off a bit from its recent exuberant posture. This week the average market exposure was 71% (up from 66% last week). And the median exposure was 75% down slightly from 78% last week.

Keep in mind that at the October 2007 top the median NAAIM exposure was at or above 90% for 5 consecutive weeks. From late January to mid Febuary, the same metric was above 91% for 4 consecutive weeks.

Rydex Advisor Confidence Index

This measures the sentiment of financial advisors. The February index was down slightly to 119.72 from January. For a chart comparison with the S&P 500 index, see above link.

Reuters Asset Allocation Poll

According to the latest Reuters asset allocation poll, global professional money managers have dropped their equity allocation to 53.6% from 54.2% in January. And they have increased their bond allocation lightly to 34.2% (from 33.7%). Finally, cash is up to 4.6% at November 2010 levels.

Towers Watson Fund Manager Survey

This survey polled 141 investment managers with $16.4 trillion assets under management to find that they are optimistic about global equities but cautious about bonds. The consensus is for a continued recovery with an expected return of 10% for equities in general.

Emerging markets fare slightly better with 85% of managers bullish for the equity sector in the next five years. Almost an equal number (79%) are bearish on government bonds. But 76% of managers were bullish on emerging market debt and there was a neutral consensus on TIPS (inflation indexed bonds).

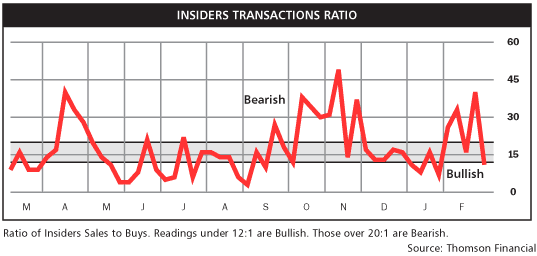

Insider Transactions

According to the insider newsletters, the Vickers Weekly Insider Report, corporate insiders reacted to the short term market declines in late February by drastically curtailing their selling. The buy-to-sell ratio went from 6.46:1 to 4.16:1. Keep in mind that a seemingly high level of selling compared to buying is normal and that this data is a week old.

According to data from Thomson Financial, the same quick about face is apparent:

Mutual Fund Flows

According to ICI mutual fund flows into equity funds this past week were $1.5 billion compared to $5.2 billion for the prior week. International funds were unchanged at $1 billion. Tetail investors are once again returning to bonds as they poured in an additional $4.5 billion into taxable bond funds. The ‘lovers spat’ between retail investors and bond funds that started in November 2010 seems to be over.

According to Lipper FMI the short turmoil in the equity market was enough to remove the vast majority of fresh money that was flowing into US domestic mutual funds. This past week US funds saw just $233 million. That was the lowest since mid December 2010 and about a 90% drop from last week.

This is the 13th consecutive week where US funds have had more inflows than their international fund counterparts. But global funds have had inflows much more consistently since this is their 26th week of consecutive inflows.

Municipal Bonds

Despite three consecutive weeks of positive returns and a positive month in February (the best since 6 months) outflows continue. According to data from Lipper FMI, a further $989 million was sold by retail investors.

The ICI figures show an outflow of $556 million during the latest week. This is the lowest weekly outflow since early December 2010 when the municipal crisis hit. For the month of Feburary, the total outflows were $4.6 billion less than half of what we saw in December and November 2010. So it would seem that things are continuing to return to normal – at least for now.

BlackRock, arguably talking their book as the largest player in the muni-bond space, sees value (WSJ: Still Seeing Value in Munis). So does Fed Chairman Bernanke: Muni-bond market looking brighter.

Gold Sentiment

The shifting sands in the gold sector are accelerating, making it a bit tricky to stay on top of sentiment readings. While I was busy congratulating myself (Gold Reaches Record High $1440) bullish sentiment has suddenly jumped on multiple indicators.

MarketVane’s Bullish Consensus jumped to 80%, which would indicate a top of some sort, if not now, then its approach. Major tops like the one seen in early 2008 are accompanied by much higher readings – at least in the 90% range for multiple days.

As well, the Hulbert Gold Newsletter Sentiment index (HGNSI) spiked suddenly in response to the breakout, going from a measly 45.3% on Tuesday to 71.9% on Wednesday. That is not too far from the all time high for the HGNSI of 89.6%.

Bloomberg’s Gold Sentiment index is also showing quite a bit of bullishness. The rolling 4 week moving average of the bull ratio is now at 85% – the highest since June 2010. Also, the 20 day rate of change of tonnes of gold held in the iShares Gold Trust ETF (IAU) is indicating an approaching top:

I don’t think a major top is here – at least we don’t have any real evidence of that yet. But we do have accumulating data that suggests that before continuing its rally, gold will need to rest here for a bit. A 10% move is not bad and for those that rode it higher, banking some of that coin would be a good idea.

Option Sentiment

Similar to the CBOE volatility index (VIX) that wasn’t able to show any real amount of concern or fear, the options market is surprisingly benign. The S&P 500 index closed the week where it closed last week and the short term moving average of the equity only CBOE put call ratio was basically unchanged at 0.61.

The ISE Sentiment index shows slightly more bullishness with a converted put/call ratio of 0.52 (the ISE is usually expressed as a call/put ratio). The most fear was shown on Tuesday with the ISE daily index falling to 127 (or 0.79 expressed as a put/call ratio). But for the most part, we are still seeing option traders predominantly concentrate on call buying with an almost 2:1 predilection.

What all this optimism is hiding is that the institutional option traders that trade a much smaller (and some would say smarter) market are very bearish. As they have been for several weeks. The S&P 100 index options has been skewed towards puts for some time. This has continued and even accelerated this past week. So much so that the 10 day average of the open interest put call ratio is now at a whopping 1.68.

The previous time the open interest ratio was this lopsided was in late July 2007. But for a few points higher in October 2007, that marked the top for equities.

Remarkably, the OEX daily put/call ratio spiked to 2.94 on Monday and 2.63 on Friday. The 10 day average spiked to an eye popping 2.10 – something we haven’t seen for decades, at least. So while it may seem that the option market is not concerned with the short term volatility in the market, some very astute traders are incredibly concerned and have been positioning themselves for weeks to take advantage of a decline.

Thanks Babak, excellent summary. I was thinking, since it’s been two weeks with big up and down days, maybe it would be valuable to also add the day at which these indicators’ values have been retrieved?

“…the Farrell Sentiment Index…is the ratio of bulls divided by the total of bears plus half of those neutral.”

Sorry, but I don’t understand the rationale behind adding half of those neutral only to the number of bears.

In fairness, it seems as though the same should be applied to the bulls side of the equation, although admittedly this would probably have a net zero effect.

“Sorry, but I don’t understand the rationale behind adding half of those neutral only to the number of bears.”

Ditto.

“In fairness, it seems as though the same should be applied to the bulls side of the equation, although admittedly this would probably have a net zero effect.”

Solve B/S = (B+N)/(S+N) where B = bulls (buyers), S (sellers) = bears and N = neutrals and you will find it reduces down to B = S.

So it would have precisely a zero net effect only if the number of bulls and bears is the same. Otherwise the impact of adding to both depends upon the ratio of bulls to bears as well as the number of neutrals versus each.

Babak, do you know whether the now-old Smith Barney “Other P/E” (Panic/Euphoria) index is still around? It had a pretty good record.

The Citigroup Panic Euphoria model is useless. Barron’s features it weekly – no idea why.

I believe Bob Farrell (retired Merrill Lynch strategist/technical analyst) used ratio of Bulls divided by (Bears + Correction), but he used Investors Intelligence sentiment, not AIA.

That would make more sense. Thanks.

Hi Babak, are we going to have some sentiment this week or next? Hope everything fine! A hello from afar.

A.B.